san antonio sales tax rate 2020

4 rows San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX. Notice of Effective Tax Rate Author.

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

There is no applicable county tax.

. Ad Find Out Sales Tax Rates For Free. Notice About Tax Rates_____ current year. There is no applicable city tax or special tax.

San Antonio collects the maximum legal local sales tax. The minimum combined 2022 sales tax rate for San Antonio Florida is 7. The San Antonio sales tax rate is 0.

The San Antonio Mta Sales Tax is collected by the merchant on all qualifying sales made within San Antonio Mta. You can find more tax rates and allowances for. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2.

The San Angelo Texas sales tax rate of 825 applies to the following six zip codes. The Texas sales tax rate is currently. 76901 76902 76903 76904 76906 and 76909.

The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. For tax rates in other cities see Florida sales taxes by city and county. San Antonio TX 78205 Phone.

State Local Sales Tax Rates As of January 1 2020. A City county and municipal rates vary. Texas Sales Tax Table at 625 - Prices from 100 to 4780 Print This Table Next Table starting at 4780 Price Tax.

The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. B Three states levy mandatory statewide local add-on sales taxes at the state level. This is the total of state county and city sales tax rates.

These rates are weighted by population to compute an average local tax rate. TX Sales Tax Rate. 8132020 15945 PM.

San Antonio Sales Tax Rates for 2022. Waco TX Sales Tax Rate. The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax.

Additional sales tax revenues if applicable. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. California 1 Utah 125 and Virginia 1.

2020 Official Tax Rates Exemptions. This is the total of state county and city sales tax rates. 2019 Official Tax Rates Exemptions.

What is the sales tax rate in San Antonio Texas. The San Antonio sales tax rate is a rate of tax a consumer must pay when purchasing goods and some services in Bexar County Texas and that a business must collect from their customers. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio.

65 rows 2020 Official Tax Rates Exemptions Name Code Tax Rate 100 Homestead 65 and Older Disabled. Wichita Falls TX. The minimum combined 2022 sales tax rate for San Antonio Texas is.

The Florida sales tax rate is currently 6. Visit our ongoing coverage of the virus and its impact on sales. The latest sales tax rates for cities in Texas TX state.

The base San Antonio Texas sales tax rate is 125 the San Antonio MTA Transit tax is 05 and the San Antonio ATD Transit rate is 025 so when combined with the Texas sales tax rate of. The County sales tax rate is. Rates include state county and city taxes.

Sales Tax Calculator Sales Tax Table. Expand as needed 2020 CityofSanAntonio. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc.

Fast Easy Tax Solutions. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. The San Antonio sales tax rate is.

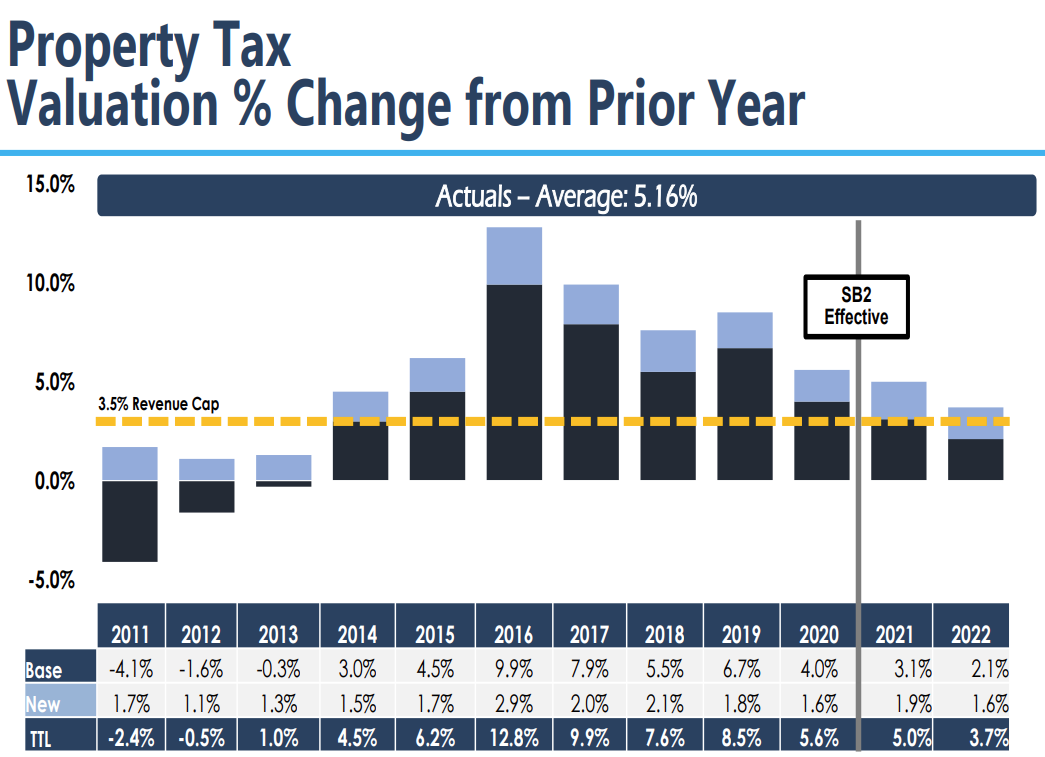

Taxing unit officials must adhere to specific procedures established in Truth and Taxation Laws when they adopt tax rates. Did South Dakota v. 2020 rates included for use while preparing your income tax deduction.

The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special district sales tax used to fund transportation districts local attractions etc. Bexar County Texas Sales Tax Rate 2021 - Avalara Bexar County Texas sales tax rate Home Texas Bexar County Bexar County Tax jurisdiction breakdown for 2022 Texas 625 San Antonio 125 San Antonio Atd Transit 025 San Antonio Mta Transit 05 Minimum combined sales tax rate value 825.

San Antonio TX Sales Tax Rate. The US average is 37. The County sales tax rate is 1.

The process used is dependent on benchmark rates known as the effective tax rate and the rollback rate. The state sales tax rate in Texas is 625 but you can customize this table as needed to reflect your applicable local sales tax rate. You can print a 7 sales tax table here.

San Antonio Texas Proposition A Sales Tax to Fund the Early Childhood Education Municipal Development Corporation November 2020.

How Does Sales Tax Work On Fitness Memberships Taxjar

Texas Sales Tax Guide And Calculator 2022 Taxjar

How To Calculate Sales Tax On Almost Anything You Buy

Sales Tax Rates In Major Cities Tax Data Tax Foundation

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

Texas Sales Tax Guide For Businesses

Texas Sales Tax Small Business Guide Truic

Texas Sales Tax Rates By City County 2022

Which Cities And States Have The Highest Sales Tax Rates Taxjar

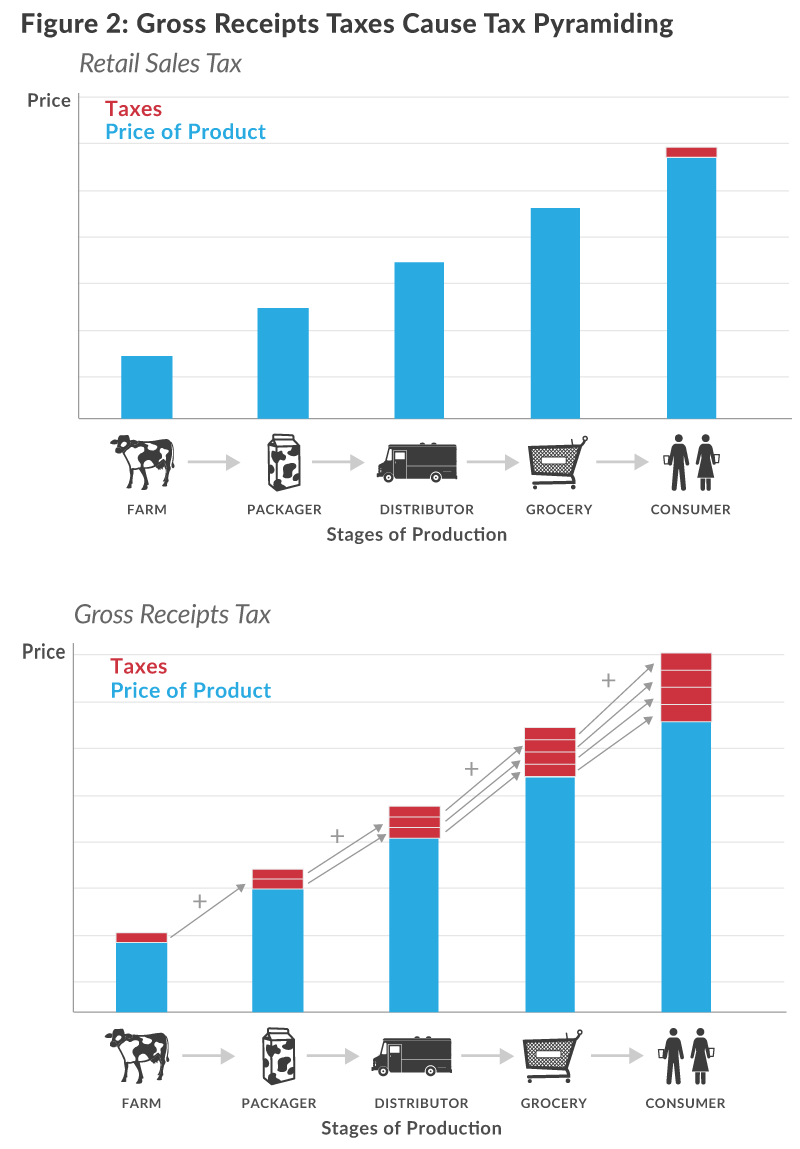

The Texas Margin Tax A Failed Experiment Tax Foundation

Realtor Selling House Tax Deductions Selling Your House

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Do You Need To Know More About Forbearance And Mortgage Relief Options Keeping Current Matters Mortgage Investment Advice Real Estate Tips